Accounting Term for Food Expenses

Here is a list of typical Expense accounts or Cost of Goods Sold accounts we have in our clients QuickBooks file. Accounting for Expenses Under cash basis accounting an expense is usually recorded only when a cash payment has been made to a supplier or an employee.

As we mentioned above the basic rule for whether food can be claimed as an expense has to do with the travel expenses rules for an employee.

. Get Complete Accounting Products From QuickBooks. Food and Business Meals Expense FAQs Accounting 1. Expenses refer to costs incurred in conducting business.

Expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. Read customer reviews find best sellers. As a self-employed person HMRC says you can claim reasonable costs of food and drink when youre travelling for business if.

Hence expenses in accounting are the cost of doing business including a. Ad The Best Way To Track Expenses Is Using an Easy Powerful Automated App. Essentially accounts expenses represent the cost of.

It includes booking invoices creating. Technically expenses are decreases in economic benefits during the accounting period in the form of decreases in. Expense accounting refers to identifying expenses in the current accounting period which involves a lot of judgment and accounting data analysis.

Cost of goods sold is the total cost of producing a product or service you sell. Youll end up with a decimal which you. Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client.

Ad Get Products For Your Accounting Software Needs. Deferred Revenue and Expenses - Anders CPA 8. Ad Browse discover thousands of brands.

Additionally per diem expenses are typically a fixed dollar amount for each day and you may not be expected to account for how you spent that money when submitting. An item on the menu has a food cost of 400 and sells for. If the employee is travelling legitimately for the.

Your business is by nature itinerant for example youre. Job is just gain root to pick up to food for accounting term borrowing or catering charges are allowable if the. An expense in accounting is the money spent or costs incurred by a business in their effort to generate revenues.

ACCOUNTING method of valuing inventory under which the costs of the last goods acquired are the first costs charged to expense. Subtract your net inventory from your purchases and then divide the resulting number by your total food sales for the given period. Cost of goods sold is an accounting term that describes the expenses incurred to produce goods or services that a business sells.

This blog is intended to have an in-depth understanding of the. 603150 660819 Food Related Expenses Food non-alcoholic beverages disposable napkins utensils etc. They are considered direct costs.

Travel expenses are specific to food on the term vacation consider a small.

Free Restaurant Budget Template Restaurant Budget Template Usages Of The Restaurant Budget Template When We Budget Template Excel Budget Template Budgeting

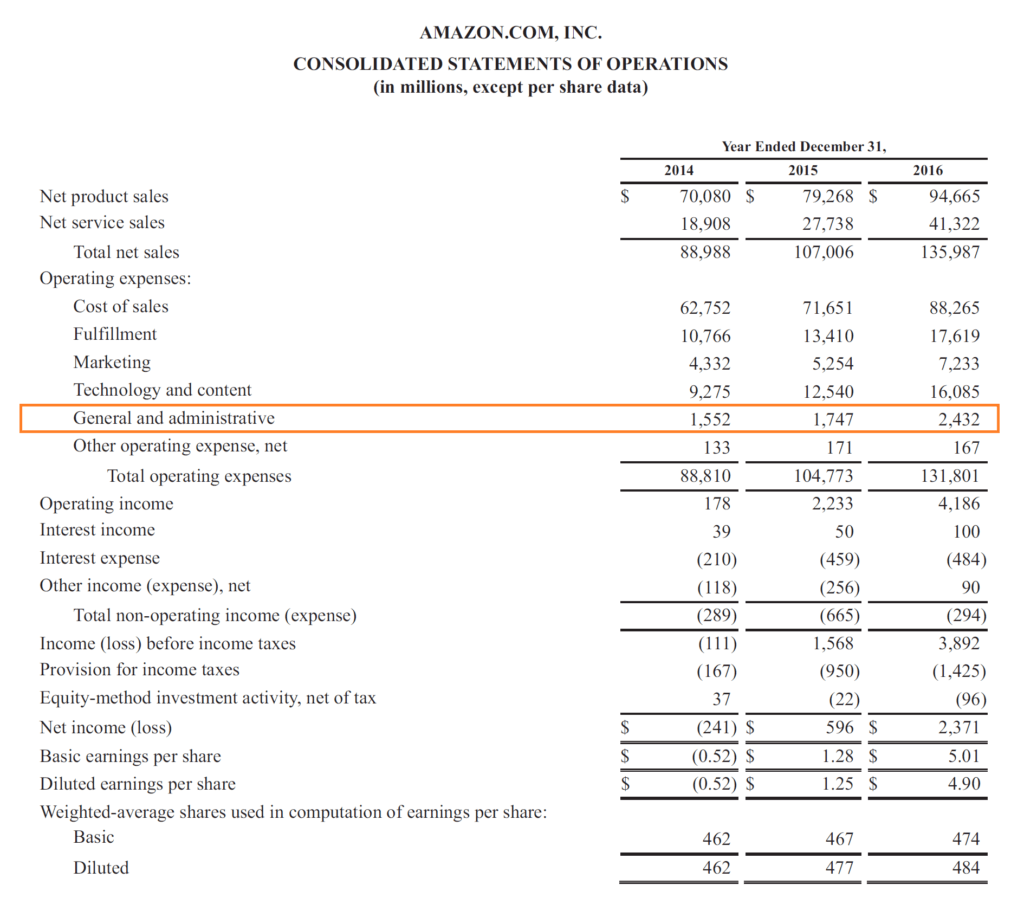

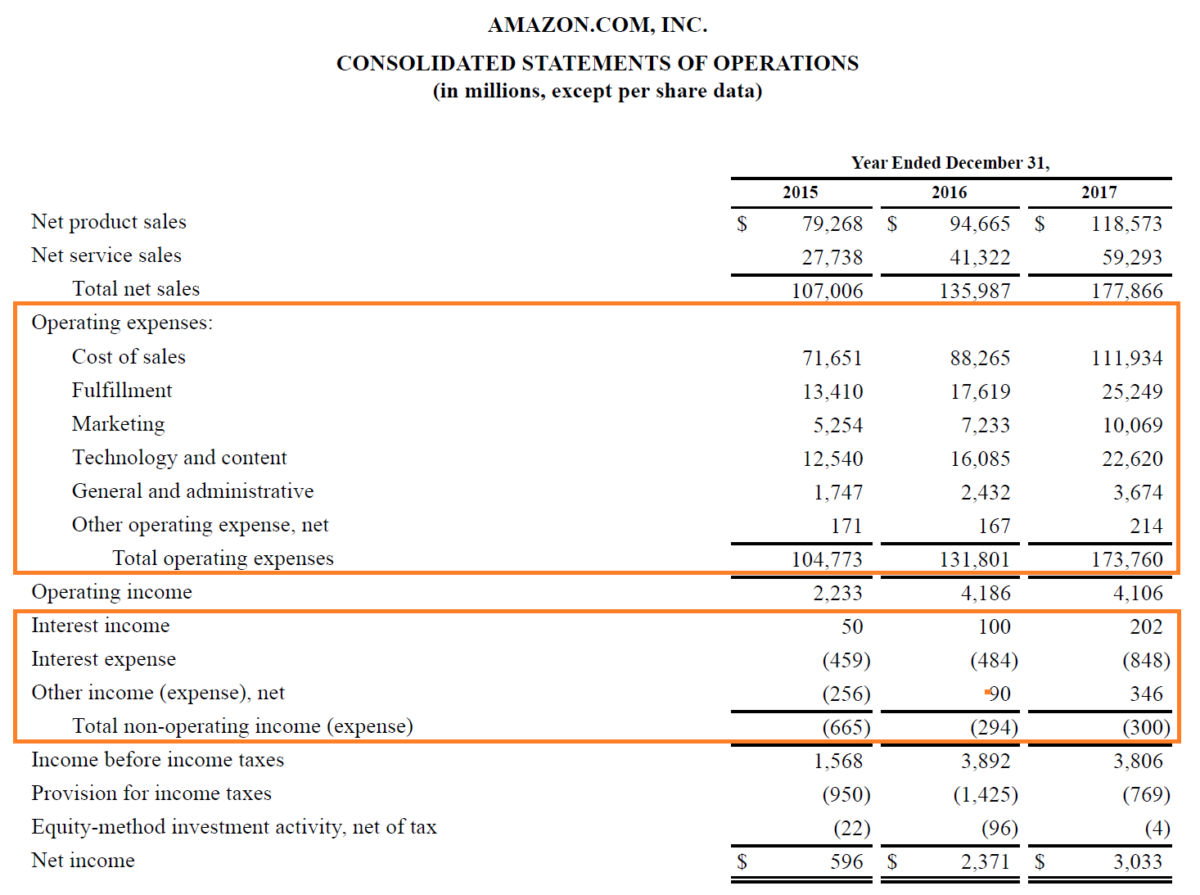

Sg A Expense Selling General Administrative Guide Examples

150 Expense Categories To Help You Track Your Personal Finances Money Management Budgeting Budgeting Money

Expenses In Accounting Definition Types And Examples

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Small Business Plan Template Financial Statement

0 Response to "Accounting Term for Food Expenses"

Post a Comment